Biden vs. Trump: How Their Tax Policies Impact Cryptocurrency

The Biden and Trump Administrations have unique tax policies that impact cryptocurrency. This post breaks down how they will impact your crypto tax bill.

October 23, 2020 · 3 min read

The US presidential election is less than three weeks away, with millions already having cast their votes. This post breaks down the potential impact of each administration's tax policy on cryptocurrency.

Current tax regime

In the United States, cryptocurrency is subject to two types of tax: capital gains tax and ordinary income tax.

Long-term capital gains tax

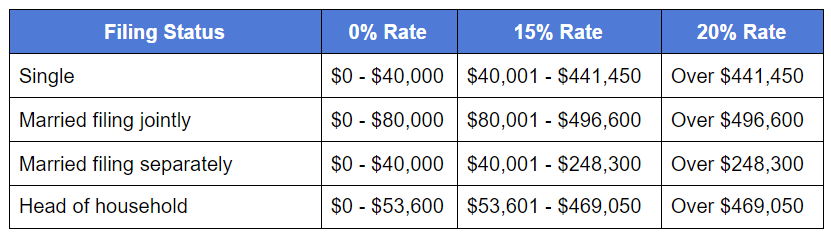

Profits coming from selling cryptocurrency held for more than 12 months (long-term capital gains) are subject to long-term capital gains tax rates. These are set at 0%, 15%, or 20%, and vary based on an individual’s income level and the filing status.

Note: the highest long-term capital gains tax rate (20%) is significantly lower than the highest ordinary income tax rate (37%).

Ordinary income tax

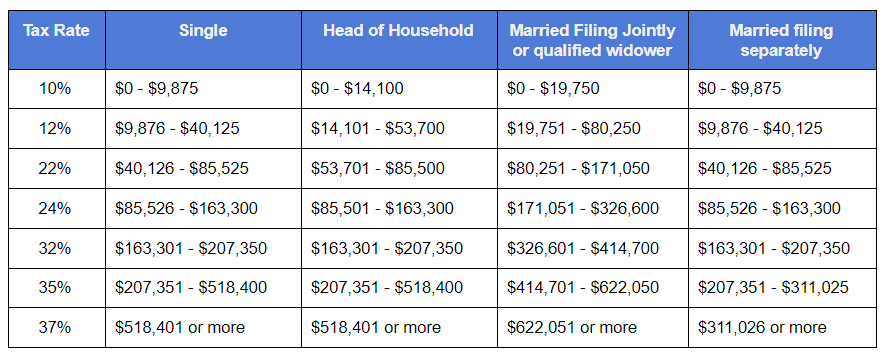

Profits coming from selling cryptocurrency held for 12 months or less (short-term capital gains), mining income, staking income, DeFi income, and airdropped income are subject to ordinary income tax rates. Ordinary income tax rates depend on an individual’s income tax bracket and the filing status.

Biden vs. Trump tax policy

Joe Biden’s Tax Plan

Biden’s tax policy aims to increase the long-term capital gains tax rate from 20% to 39.6% for those who make more than a million dollars of income per year. While this proposed doubling of tax rate may seem alarming, the proposal may not have a widespread impact. In 2018, about 153 million taxpayers filed tax returns with the IRS. Among them, only about 540,000 reported an adjusted income over a million dollars, representing less than 1% of US taxpayers. Under Biden's administration, this small segment of taxpayers would incur a higher tax bill for long-term capital gains.

This small segment of high-income taxpayers may also include those sitting on large unrealized long-term gains wanting to cash out those positions before the higher tax rate kicks in. Therefore, we may see large sell-offs by crypto hodlers before the new rules come into effect (perhaps followed by re-purchases at a higher cost basis).

Biden’s policy also increases the highest ordinary income tax rate from 37% to 39.6%. This means that individuals earning wages in cryptocurrency, generating ordinary income from crypto mining, staking, or short-term capital gains, and making over $400,000 of annual income, would see a slight increase in taxes.

Donald Trump’s Tax Plan

President Trump has not officially published a formal tax plan, though he has said that he's "not a fan of Bitcoin and other Cryptocurrencies." However, he has pledged that he would bring down the highest long-term capital gains tax rate from 20% to 15%. If this were to come to fruition, holding crypto assets for more than 12 months would unlock even lower long-term capital gains tax rates. However, to actually realize this tax discount under Trump’s pledge, an individual’s total income would have to exceed $441,500 (single filers) or $496,600 (married filers). Taxpayers with income below these thresholds will not see a difference in their tax bill.

Summary

In short, most individuals would see no difference in cryptocurrency taxes under a Biden Administration vs. Trump Administration. Those above ~$400,000 in income would see a decrease in taxes under President Trump versus a slight increase in taxes under a Biden presidency. Ultra high-income taxpayers above a million dollars per year income would see a substantial increase to taxes under a Biden presidency.

If you have any questions or comments about how the upcoming election would affect cryptocurrency, please let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes crypto taxes simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.