IRS Cryptocurrency Tax Letter Guide: 6173, 6174, 6174-A, CP-2000

The IRS has started sending out tens of thousands of cryptocurrency tax warning letters. Here's everything you need to know to get compliant hassle-free.

August 25, 2020 · 2 min read

Have you received a warning letter from the IRS about your cryptocurrency taxes (IRS Letter 6173, IRS Letter 6174, IRS Letter 6174-A, IRS Notice CP2000)? If so, you have come to the right place. Don’t stress, we’ll have you on your way in 15 minutes. Here’s what you need to do:

Step 1: Create a CoinTracker account

To get started, you’ll want to create a free CoinTracker account.

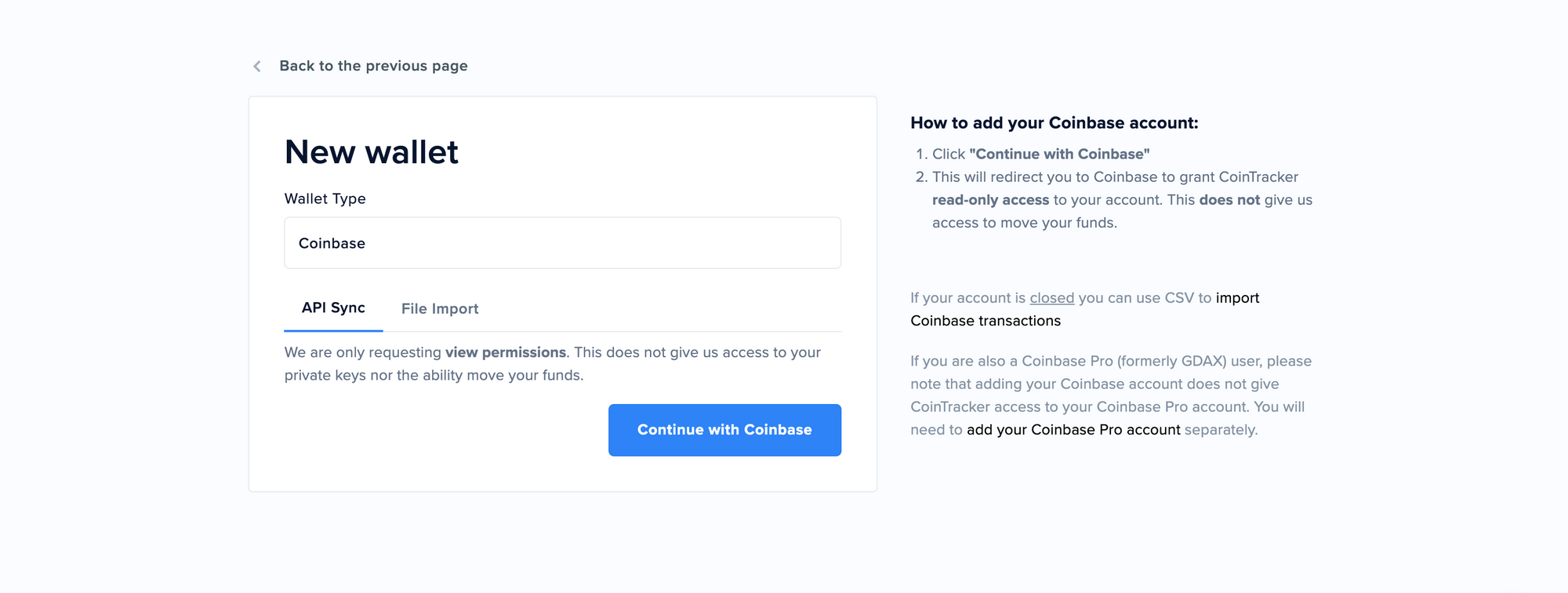

Step 2: Add your crypto exchanges and wallets

Add ALL of your cryptocurrency exchanges and off-exchange wallets to CoinTracker.

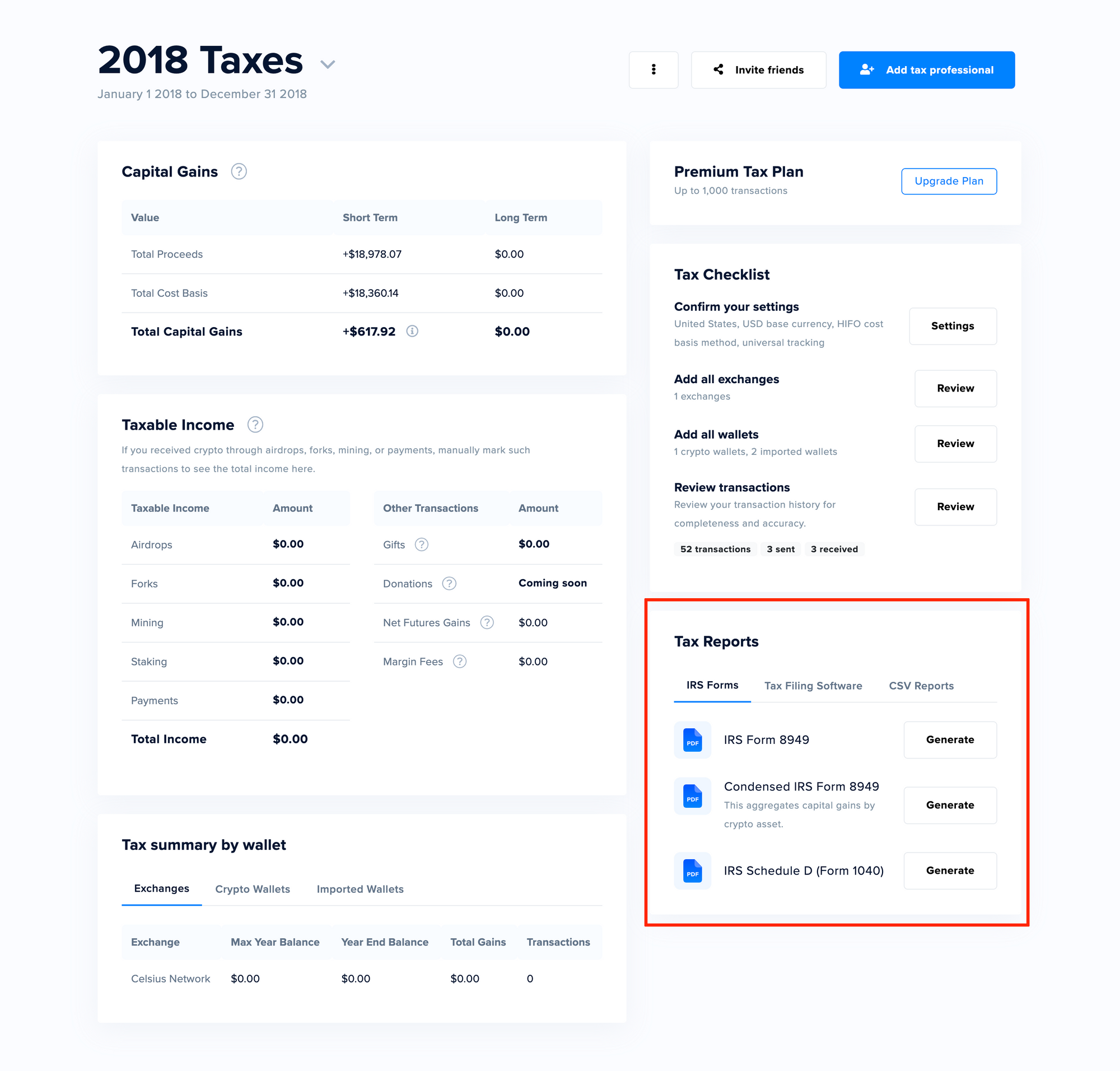

Step 3: Get a tax plan

Purchase a tax plan for each year that you had cryptocurrency capital gains (you can check on the tax page).

Step 4: Download your tax reports

Download your tax reports from the tax page.

Step 5: Amend your tax return

If you have not filed your cryptocurrency taxes (or your filings were incomplete) for previous years, amend your tax return(s) using the newly generated tax reports.

Step 6: Respond to the IRS

We recommend speaking with a tax professional about your situation. If you are already working with someone, you can share your tax reports with them. If you would like to be connected to a new accountant, you can personalize one of the same letters below, and reach out to us to get connected to a crypto CPA:

- Sample CP2000 response letter

- Sample 6173 response letter

- 6174 or 6174-A: these letters do not require a response (you should still file an amended return if your previous filing was not accurate, if applicable)

Frequently Asked Questions

How do cryptocurrency taxes work?

Check out our cryptocurrency tax guide.

How can I file my cryptocurrency taxes?

CoinTracker works with TurboTax, TaxAct, H&R Block, your own accountant, or we can connect you with a new crypto accountant. You can also use the forms we generate to file yourself.

I still have questions about cryptocurrency and bitcoin taxes

For more information, please see the CoinTracker FAQ, community forum, or message us directly — we’d love to chat with you!

Disclaimer: CoinTracker is provided for informational purposes only. This service is not intended to substitute for tax, audit, accounting, investment, financial, nor legal advice. For financial, tax, or legal advice please consult your own professional. Please see our full disclaimer.